What Is Vishing?

Vishing is social engineering by voice. Scammers call or send voice notes pretending to be a bank, courier, tech support, HR, tax authority, or even a colleague. The goal is to trigger urgency, then steer you into handing over credentials, one-time codes, payments, or remote access.

Key pillars of vishing:

-

A trusted disguise. Spoofed caller ID and convincing scripts mimic brands or people you know.

-

Urgency and fear. “Your account is locked,” “IRS lawsuit filed,” “CEO needs a wire now,” “Your child is in danger.”

-

A quick path to loss. The caller pushes you to read out OTPs, install remote tools, or move money.

If you remember one line from “what is vishing”: it’s any phone-based ploy that trades on panic and trust to steal something valuable.

How Vishing Works

Most campaigns follow a repeatable playbook. Knowing the steps helps you interrupt them.

-

Recon & targeting

-

Attackers mine public data (LinkedIn, breached databases, social feeds). They tailor names, titles, and context so the call feels legit.

-

-

Initial contact

-

Methods include direct calls, voicemail drops, voice notes in messaging apps, or a text that escalates to a call (“call this number to prevent account closure”). This often combines smishing (SMS phishing) with vishing.

-

-

Caller ID spoofing

-

The visible number may match your bank’s published line. Spoofing is trivial with VoIP, which is why caller ID alone is not proof.

-

-

Pretext & pressure

-

The script frames a crisis (“fraud on your card”) or an authority request (“IT needs to reverify”). Scarcity (“do it in the next 5 minutes”) pries you off your normal safety habits.

-

-

Capture & pivot

-

Victims are guided to reveal credentials/OTPs, sign bogus forms, download “security tools,” or send payments. If credentials are stolen, attackers log in immediately and may call again to keep control (“stay on the line while we secure your account”).

-

-

Cover tracks

-

Funds are laundered through mule accounts or crypto; remote tools and call histories are wiped; numbers are burned and replaced.

-

Understanding this flow lets you cut the scam at the first pressure cue.

Vishing Examples and Red Flags

Here are common vishing examples—and the tells that expose them:

-

Bank “fraud department”

-

Script: “We detected a $1,227 charge. Read the code we just texted so we can cancel it.”

-

Red flags: Asks for OTPs/PINs; insists you stay on the line; caller rushes you.

-

Fix: Hang up. Call the bank using the number on your card or app, not a number given by the caller.

-

-

Tech support (Microsoft/Apple/ISP)

-

Script: “Your computer is sending malware; install our tool.”

-

Red flags: Requests remote-control software, gift cards, or crypto.

-

Fix: Never install tools from unsolicited calls. Contact the company via its official website.

-

-

Delivery/courier

-

Script: “We can’t deliver your parcel; pay a small re-delivery fee now.”

-

Red flags: Payment over the phone; mismatched tracking links; aggressive upselling.

-

Fix: Check your order history or the courier’s official app/site directly.

-

-

Tax/benefits/immigration

-

Script: “Immediate payment avoids arrest/visa issues.”

-

Red flags: Threats of legal action, unusual payment methods, no written notice.

-

Fix: Government agencies rarely demand instant payment by phone.

-

-

Workplace “CEO” or “IT”

-

Script: “Urgent wire before end-of-day,” “read me the MFA code so I can unblock your account.”

-

Red flags: Bypassing standard approvals; secrecy; private numbers.

-

Fix: Verify via a second channel (Slack, corporate phone book). Follow your payment/MFA policy.

-

Common red flags across all vishing examples: pressure to act now, secrecy, off-platform payment requests, and refusal to let you call back through official channels.

Personal Checklist: How to Stop Vishing

Use this concise vishing prevention checklist at home and on the go:

-

Never read out a one-time code

OTPs (2FA codes) are the crown jewels. No legitimate agent needs them. -

Hang up and call back

End the call. Use the official number from a card, bill, app, or website. If it’s real, you’ll reach the right team. -

Set account PINs and verbal passwords

With banks, carriers, and utilities, add a phone PIN and require it for changes. This blocks many phone-only takeovers. -

Freeze credit and enable alerts

Credit freezes stop new-account fraud. Turn on transaction alerts for cards and bank accounts. -

Lock down SIM and voicemail

Add a carrier account PIN/port freeze. Disable default voicemail PINs. -

Use passkeys or strong, unique passwords + MFA

A password manager removes reuse; passkeys reduce phishing risk by design. -

Don’t install software from a caller

Remote-control tools are a hard “no” unless you initiated a support session via an official site. -

Protect calls and logins on public Wi-Fi

Public networks are noisy and risky. Connect UFO VPN before entering credentials or joining VoIP calls on café/hotel/airport Wi-Fi. Encrypted tunnels reduce snooping and session hijacking opportunities. -

Document and report

Save the number, time, and script. Report to your bank, carrier, local consumer authority, and, when applicable, your company’s security team.

These steps neutralize the vast majority of opportunistic vishing attempts.

Company Playbook to Reduce Vishing Risk

Organizations are prime targets. Bake vishing prevention into policy and culture:

-

Single “safe callback” number

Publish one verified inbound number for employees to reach IT/HR/Finance. Train staff to hang up unsolicited calls and dial that number. -

No-OTP-over-voice rule

Formalize a policy: employees must never read OTP/MFA codes or share password reset links by voice. -

Payment approvals & out-of-band checks

Require multi-person sign-off for wires or vendor changes; verify requests via a second channel (directory-listed extensions, corporate chat). -

Help desk scripts with identity proofing

Tier-1 support should use preapproved questions and caller verification (employee ID + directory photo/metadata checks), not ad-hoc judgments. -

Number spoofing warnings on softphones

Many PBXs/UCaaS systems can flag or label probable spoofed calls and block high-risk country codes by default. -

Tabletop exercises

Run short, realistic vishing drills for finance, support, and executives. Practice saying, “I’m hanging up and calling you back on the company number.” -

Secure the network edge

Enforce DNS filtering, email security for voicemail-to-email attachments, and endpoint protection. Encourage free proxy VPN in UFO VPN for staff on travel or home networks so credentials aren’t exposed on unsafe Wi-Fi.

A crisp playbook converts training into reflex.

A VPN Helps You Face Vishing

A VPN isn’t anti-vishing magic—but it’s a valuable part of your hygiene.

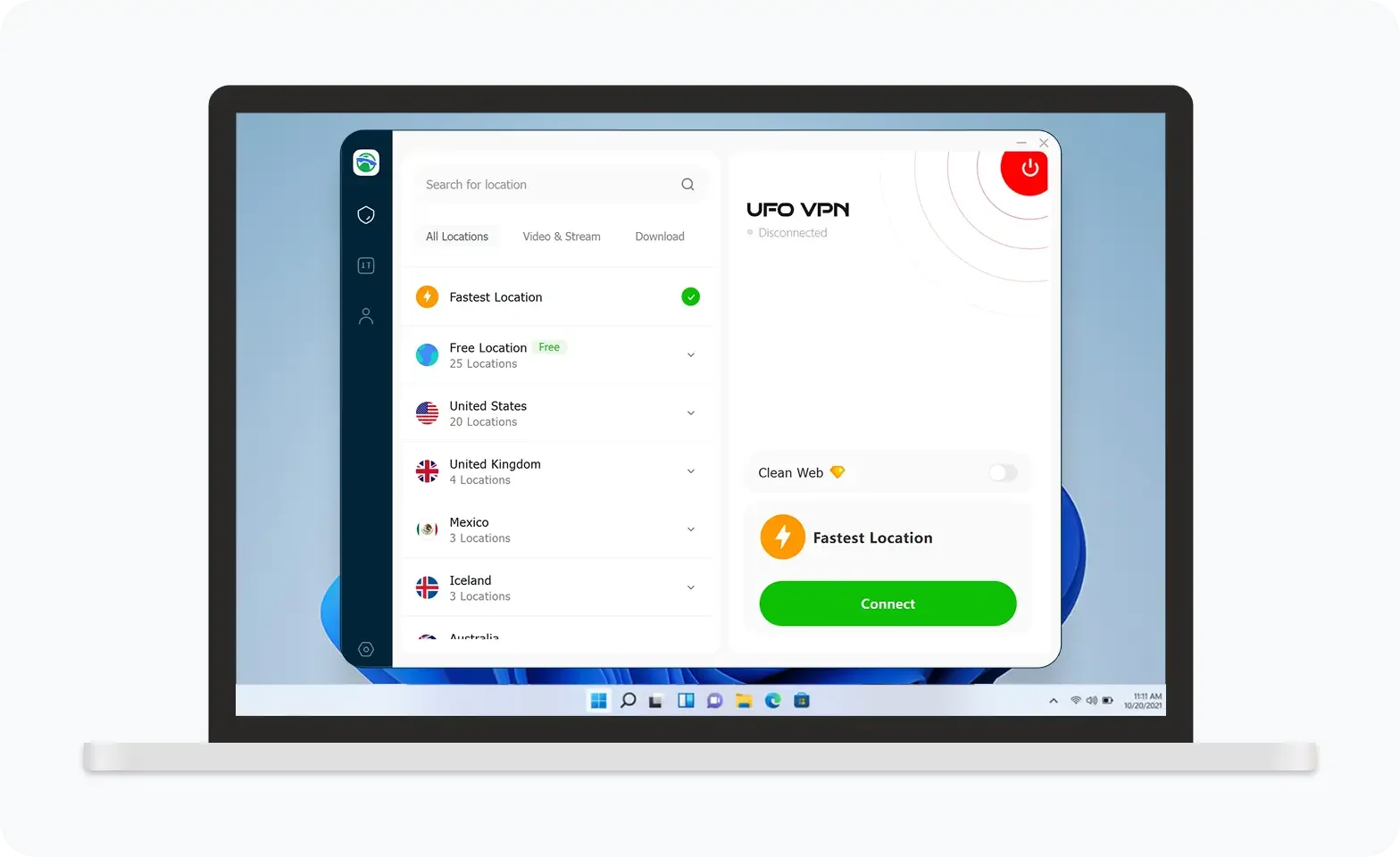

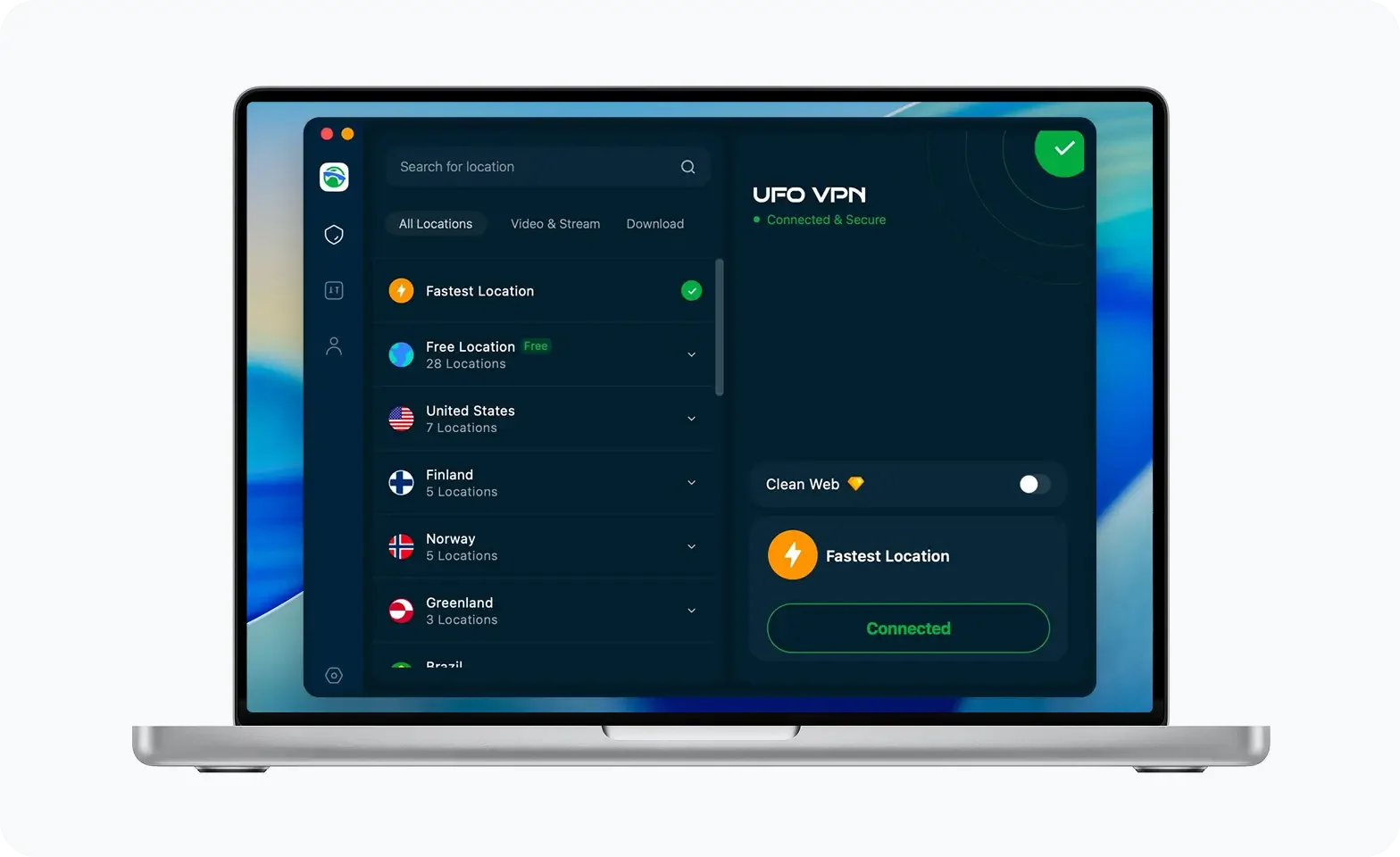

Where a VPN like UFO VPN helps

-

Public Wi-Fi safety: Encrypts traffic on hostile networks, reducing on-path snooping during VoIP calls (Teams/Zoom/SIP) and when logging into bank/email after a call.

-

IP masking: Hides your real IP from sites and ad networks that could couple your identity with call-driven lures.

-

Auto-connect on untrusted Wi-Fi: If supported, UFO VPN can connect automatically on open networks so you don’t forget.

What a VPN does not do

-

It won’t stop caller-ID spoofing or verify who’s on the other end of a call.

-

It won’t replace verification—you still must hang up and call back via official numbers.

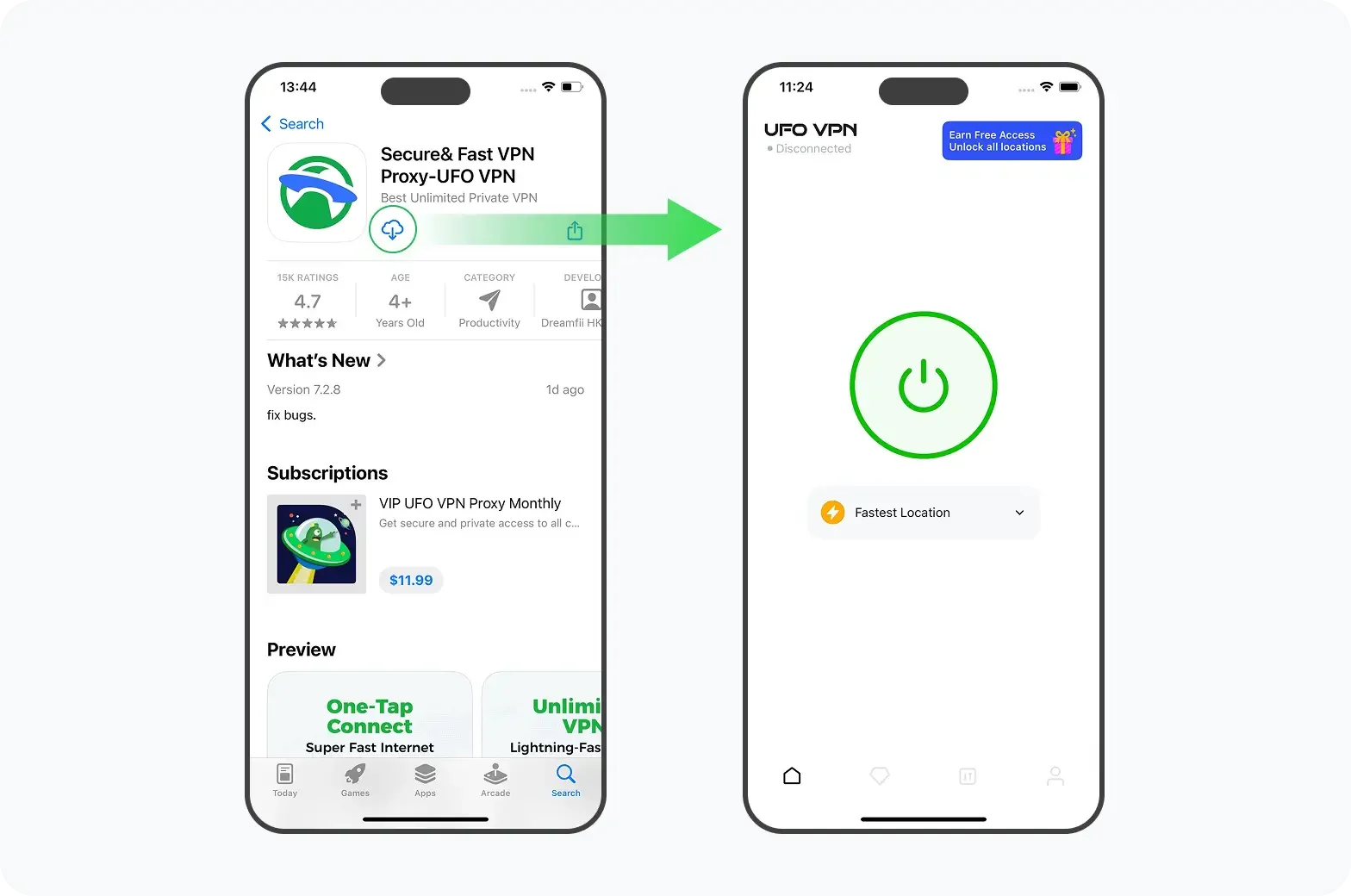

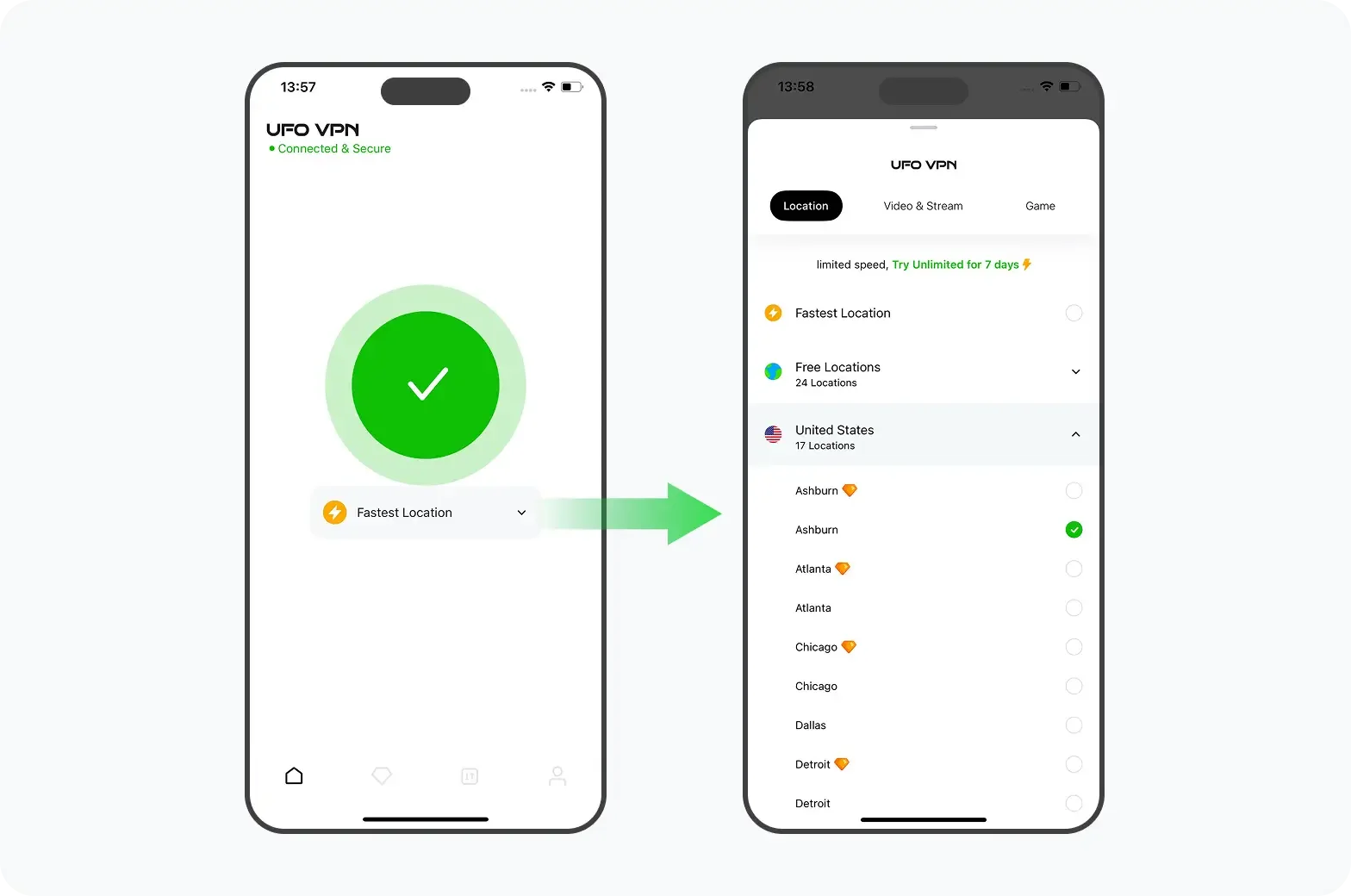

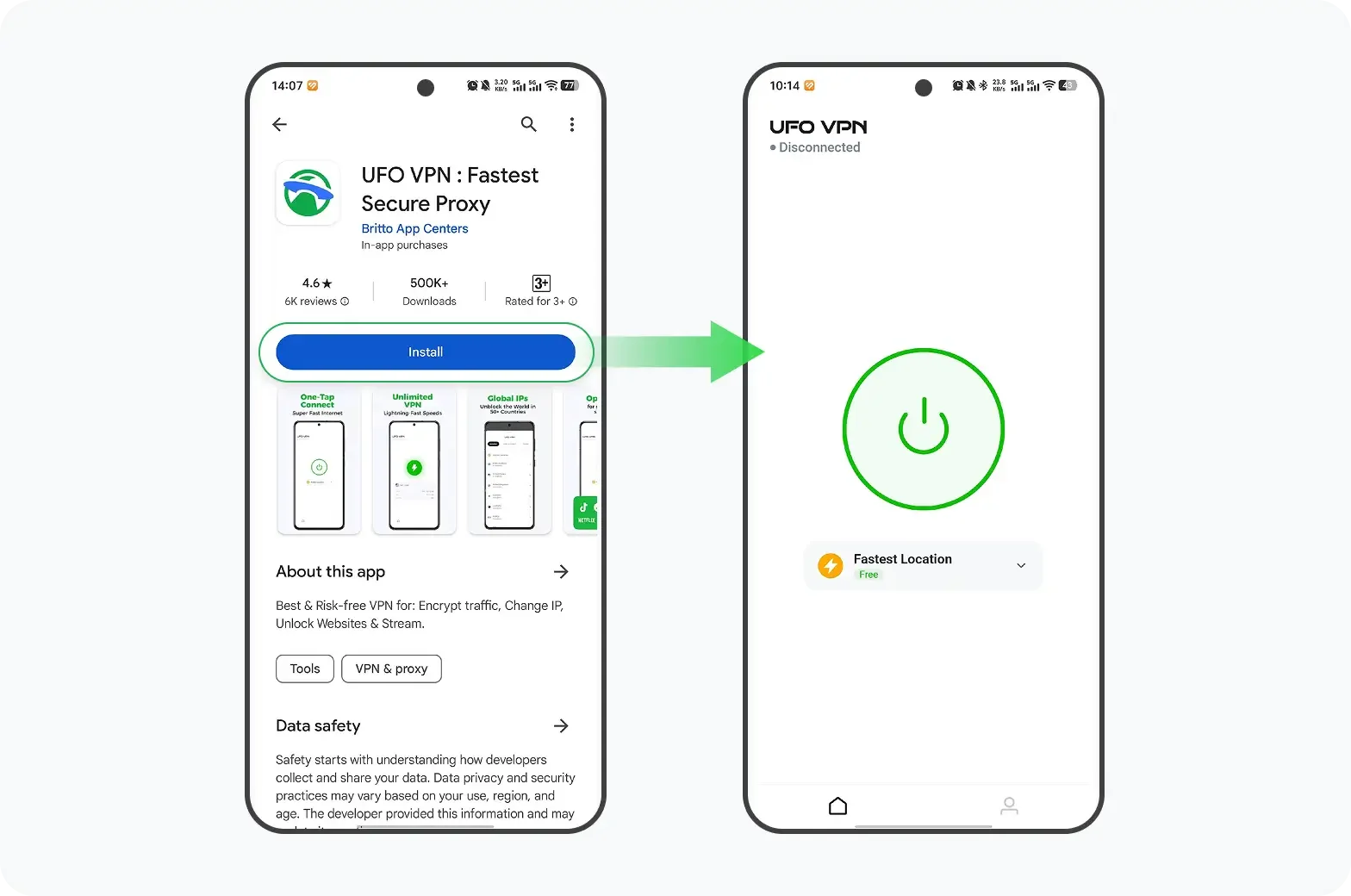

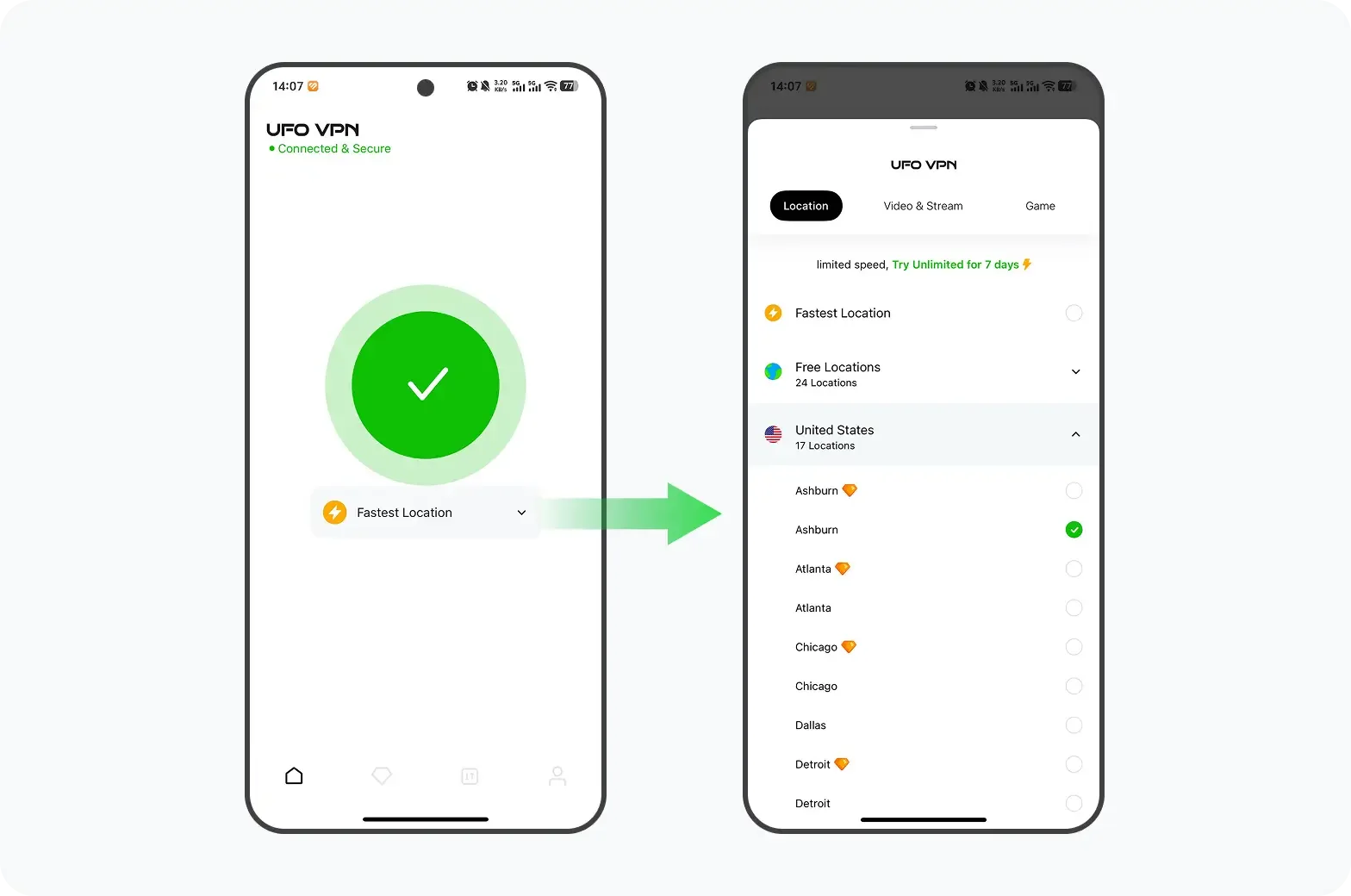

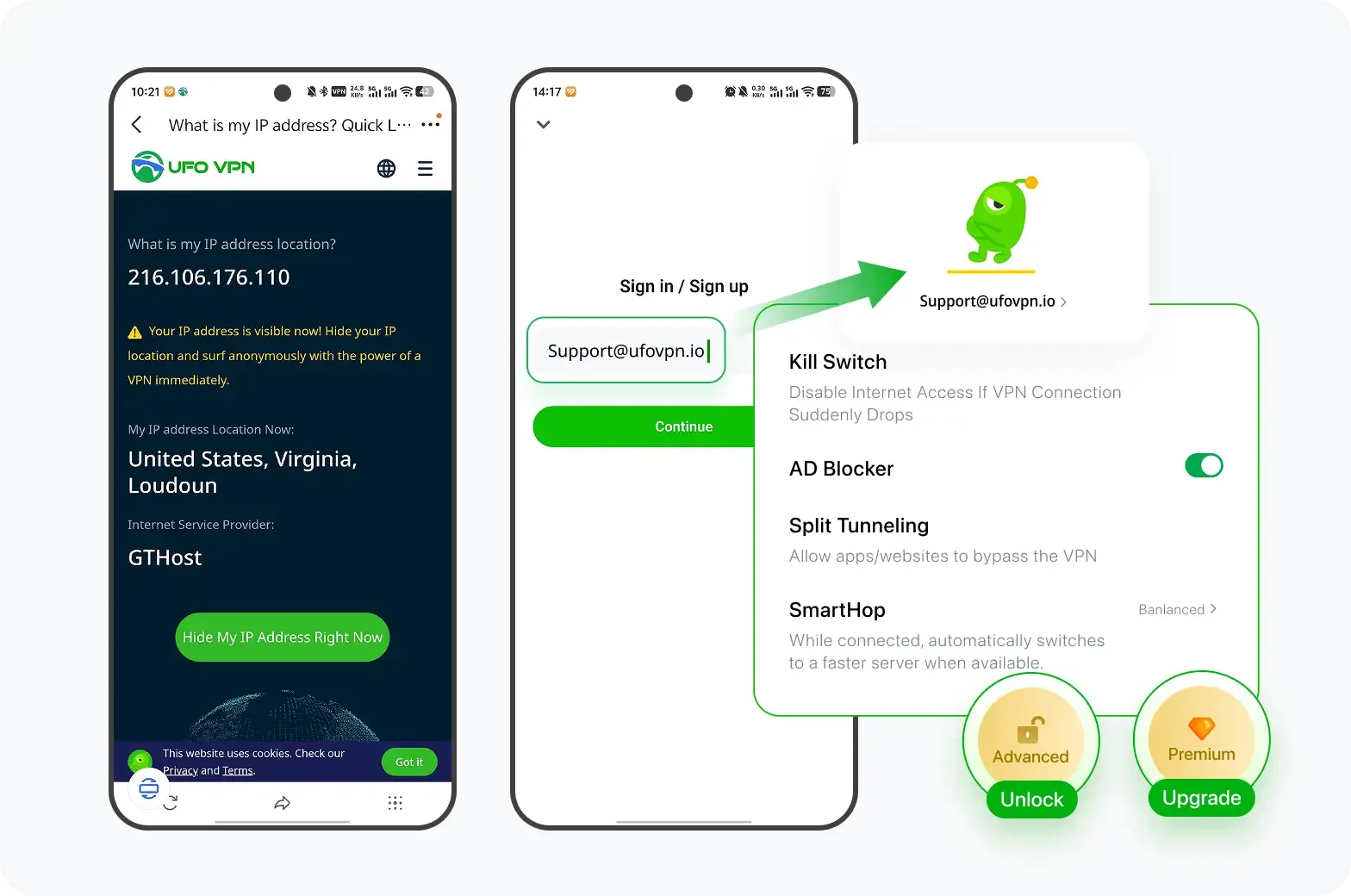

Quick start with UFO VPN

UFO VPN is an all-in-one VPN that offers unlimited access to 4D streaming like Netlfix, Disney Plus, no-ping gaming as PUBG, Roblox, CODM and social networking for YouTube, X, Facebook and more.

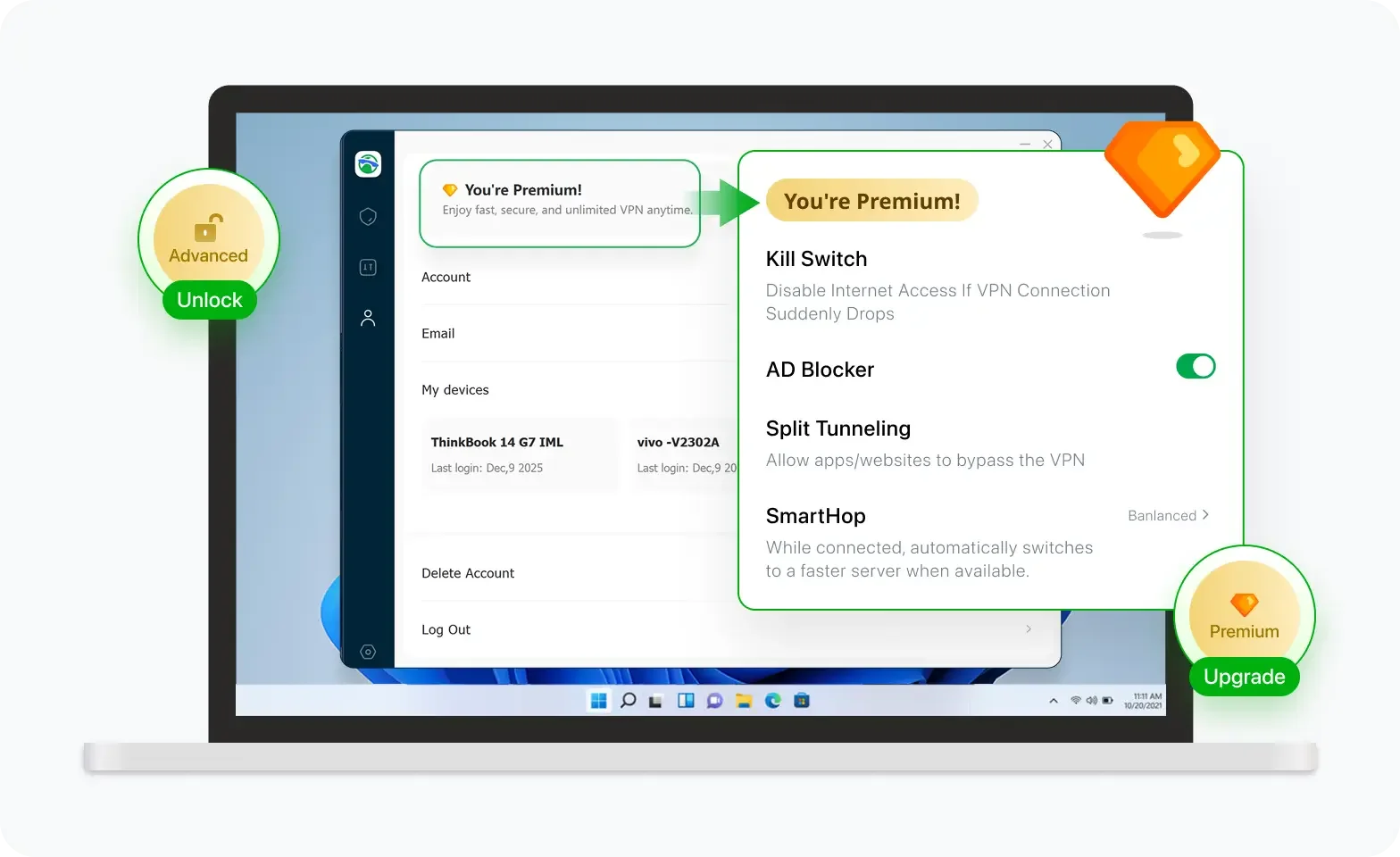

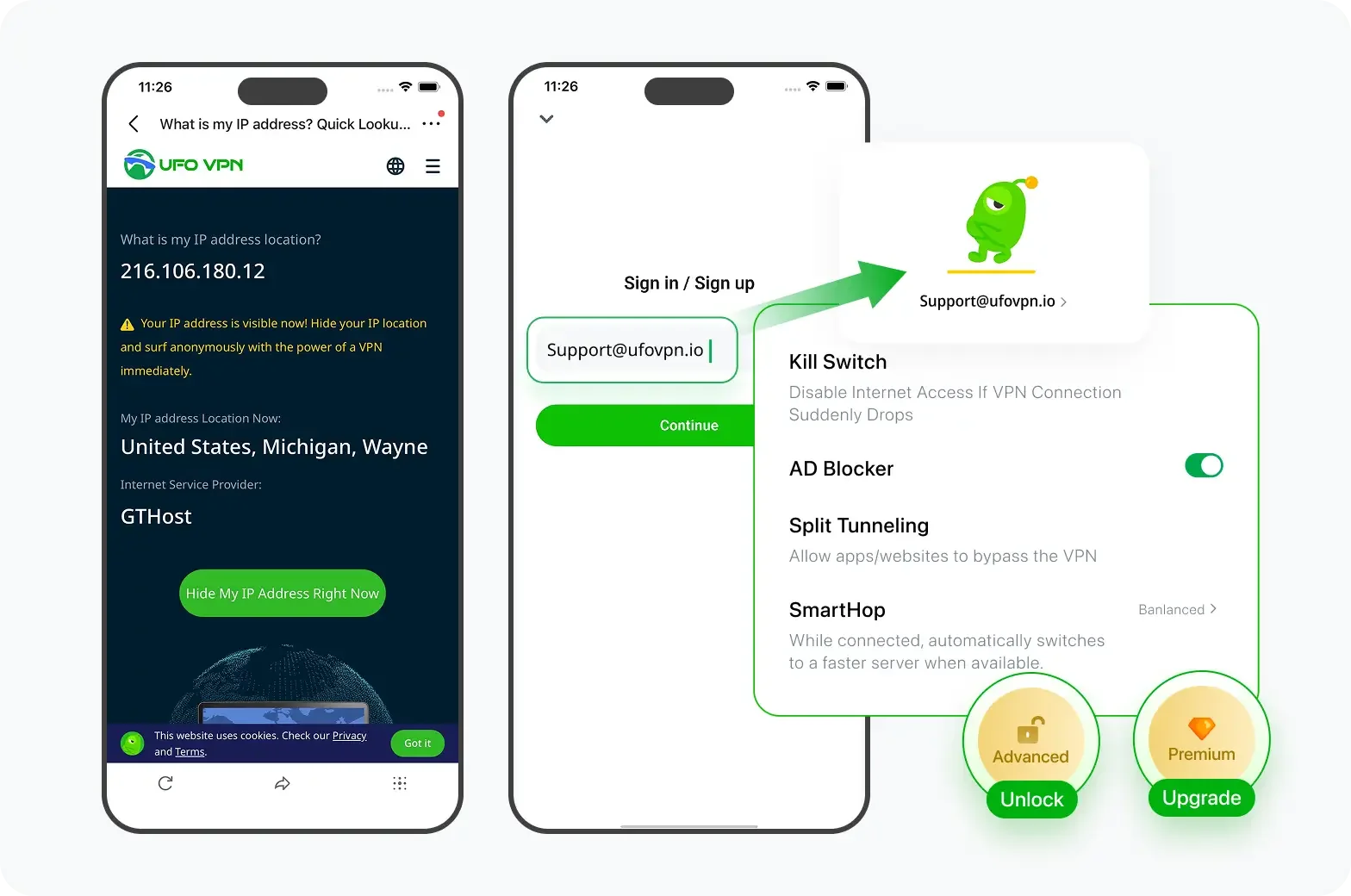

Unlock Pro Features

If you have upgraded to premium plan , feel free to enjoy premium servers for 4K streaming and advanced features like Kill Switch, Split Tunneling, and gaming acceleration. Your Mac is now fully optimized and protected. Inaddition to basic functions, we recommend you turn on

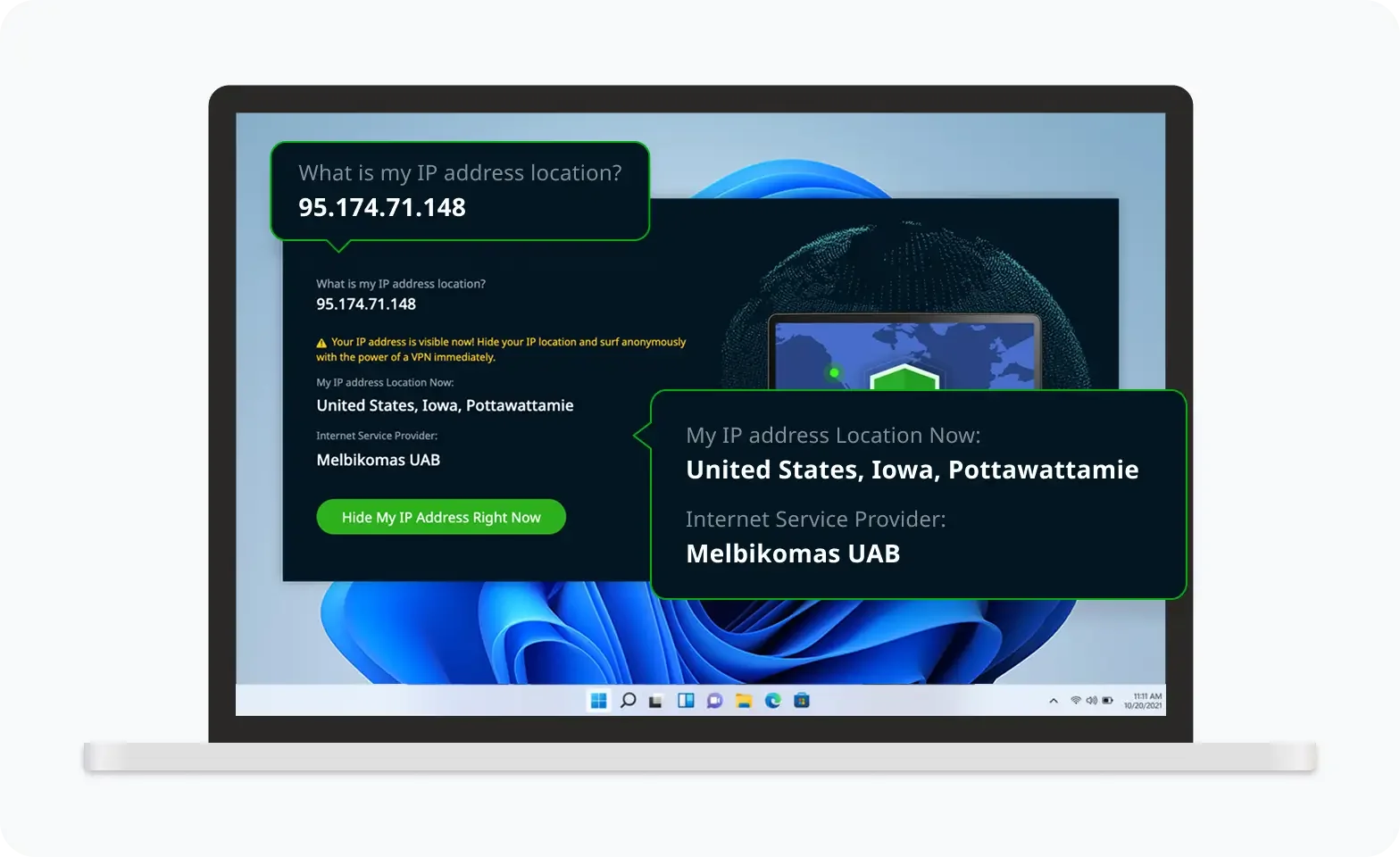

Verify Your IP Now

Use UFO VPN's " What is My IP " feature to see your new IP and location. This confirms your connection is secure, anonymous, and ready for safe browsing online anywhere at any time.

FAQs

Is vishing the same as phishing?

Phishing is a broad category of social engineering; vishing uses voice calls/VoIP, smishing uses SMS, and phishing often uses email/web.

How can I verify a legitimate call?

Hang up and call the organization using a number from its official site, card, or app. Never rely on numbers given during the call.

What if I read out a one-time code by mistake?

Assume account compromise. Log out of all sessions, change passwords, revoke tokens, and contact the provider’s fraud team immediately. Monitor transactions and set alerts.

My caller ID showed my bank—doesn’t that prove it’s real?

No. Caller ID spoofing is easy. Trust only call-backs to published numbers.

Are older relatives at higher risk? How can I help?

Yes—fraudsters target those who are less tech-savvy. Post a “Do Not Answer Unknown Numbers” note near the phone, set up call screening, and rehearse hang-up/callback steps.