What Are CCSPayment Scams?

CCSPayment scams are fraudulent schemes designed to trick users into believing they are engaging in legitimate financial transactions. These scams often use sophisticated tactics to mimic trusted payment systems, luring victims into providing sensitive financial information or authorizing unauthorized transactions.

Key Characteristics

- Imitation of Legitimate Services: Fraudsters mimic real payment platforms, using similar logos, web designs, and email templates.

- Phishing Tactics: Often initiated through phishing emails, fake websites, or pop-up notifications that prompt users to verify or update their payment information.

- Social Engineering: Scammers exploit human psychology, using urgent language or threats to induce panic and prompt immediate action.

- Fake Customer Support: Some scams even offer “customer support” to handle supposed issues with your payment, further misleading victims into trusting the scam.

Understanding what constitutes a CCSPayment scam is the first step toward protecting your digital finances and ensuring online security.

How CCSPayment Scams Work

To effectively protect yourself, it’s essential to understand the modus operandi behind CCSPayment scams. These schemes typically unfold in several stages:

1. Initial Contact

Scammers often reach out via email, social media, or even text messages. The communication is designed to look official, frequently incorporating logos, branding, and language that resembles that of legitimate financial institutions.

- Phishing Emails: Emails that claim to be from a trusted payment provider, asking you to verify your account details.

- Pop-up Ads and Fake Websites: Online ads or websites that mimic the look of authentic payment portals.

2. Credential Harvesting

Once a user clicks on the fraudulent link or opens an attachment, they’re prompted to enter sensitive information such as login credentials, credit card numbers, or security questions. This data is then captured by the scammers.

3. Exploitation

With your credentials in hand, fraudsters can:

- Make Unauthorized Transactions: They might use your payment details to drain your account.

- Sell Your Information: Your personal and financial data could be sold on the dark web.

- Install Malware: In some cases, clicking on a scam link may install malware on your device, further compromising your data.

4. Cover-Up and Disappearance

After executing the scam, perpetrators quickly vanish, leaving victims with unauthorized transactions and a lengthy recovery process.

By understanding these stages, you can be more vigilant and better prepared to avoid falling victim to CCSPayment scams.

Common Red Flags and Warning Signs

Recognizing the warning signs of a CCSPayment scam is critical. Here are some common red flags that may indicate fraudulent activity:

1. Unsolicited Communication

- Unexpected Emails or Messages: Be wary of unsolicited emails or messages, especially if they ask for personal or financial information.

- Generic Greetings: Scammers often use generic salutations such as “Dear Customer” instead of your actual name.

2. Urgent or Threatening Language

- Immediate Action Required: Scammers create a sense of urgency, claiming your account will be suspended or funds will be lost if you do not act immediately.

- Threats of Penalties: Some messages may include threats of legal action or account closure to scare you into compliance.

3. Suspicious Links and Attachments

- Unknown URLs: Hover over links to see if the URL matches the legitimate website of the claimed organization.

- Unsolicited Attachments: Be cautious with attachments, as they may contain malware designed to steal your information.

4. Poor Grammar and Spelling

- Language Mistakes: Many scam emails contain noticeable grammatical errors and spelling mistakes, which can be a sign of fraud.

5. Requests for Unusual Payment Methods

- Prepaid Cards or Cryptocurrency: If you’re asked to make payments via unconventional methods, it’s likely a scam.

Awareness of these red flags can help you quickly identify potential CCSPayment fraud attempts before any harm is done.

Real-Life Examples of CCSPayment Fraud

Understanding real-life cases of CCSPayment scams can provide valuable insights into how these frauds operate. Here are a few examples:

Example 1: The Urgent Account Update Scam

A victim received an email claiming that their CCSPayment account required immediate verification due to suspicious activity. The email provided a link that led to a counterfeit website resembling the official CCSPayment portal. Once the victim entered their login credentials, the scammers used them to initiate unauthorized transactions.

Example 2: The Payment Refund Trick

In another instance, fraudsters contacted several individuals, claiming that they were eligible for a refund due to overcharges. Victims were instructed to provide their bank details to process the refund. Instead of receiving money, victims found their accounts compromised as the scammers siphoned off funds.

Example 3: The Malware-Inflicted Scam

Some scams involve the installation of malware through malicious attachments. A user, upon receiving an email from a seemingly legitimate source, downloaded an attachment labeled “Refund Details.” The malware silently recorded keystrokes and sent personal and financial data to the attackers.

These examples underscore the importance of vigilance and the need to verify the authenticity of any communication related to financial transactions.

Preventive Measures to Avoid CCSPayment Scams

Prevention is the best strategy when it comes to avoiding CCSPayment scams. Here are actionable steps to protect yourself:

1. Verify Authenticity

- Direct Contact: Always contact the company directly using contact information from their official website before responding to any suspicious communication.

- Check Email Addresses: Verify that the sender’s email address is legitimate. Official communications typically come from a verified domain.

2. Use Multi-Factor Authentication (MFA)

- Additional Layer of Security: Enable MFA on all financial accounts. This requires a second form of verification, making it significantly harder for scammers to gain access even if they obtain your password.

3. Educate Yourself and Others

- Stay Updated on Scam Tactics: Regularly read up on the latest scam techniques and fraud alerts from reliable sources.

- Share Knowledge: Inform friends, family, and colleagues about the warning signs of CCSPayment scams to help them avoid falling victim.

4. Regular Monitoring

- Account Activity: Regularly review your bank and credit card statements for any unauthorized transactions.

- Credit Reports: Periodically check your credit reports for discrepancies or signs of fraudulent activity.

5. Use Security Tools

- Antivirus and Anti-Malware Software: Keep your devices protected with reliable security software.

- Secure Browsing Practices: Use secure browsers, and consider using privacy-focused extensions to block malicious content.

By adopting these preventive measures, you can significantly reduce the risk of becoming a victim of CCSPayment scams.

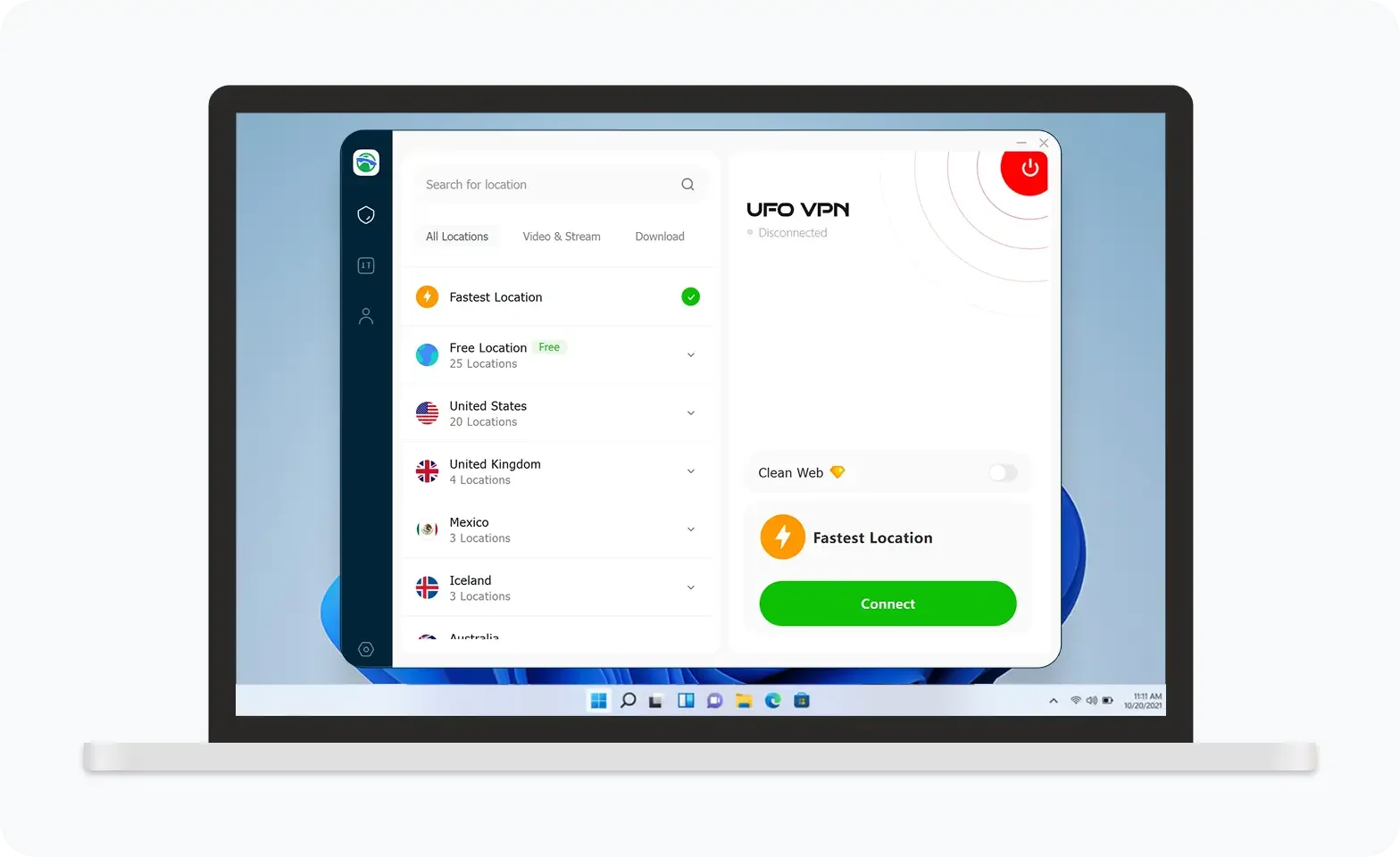

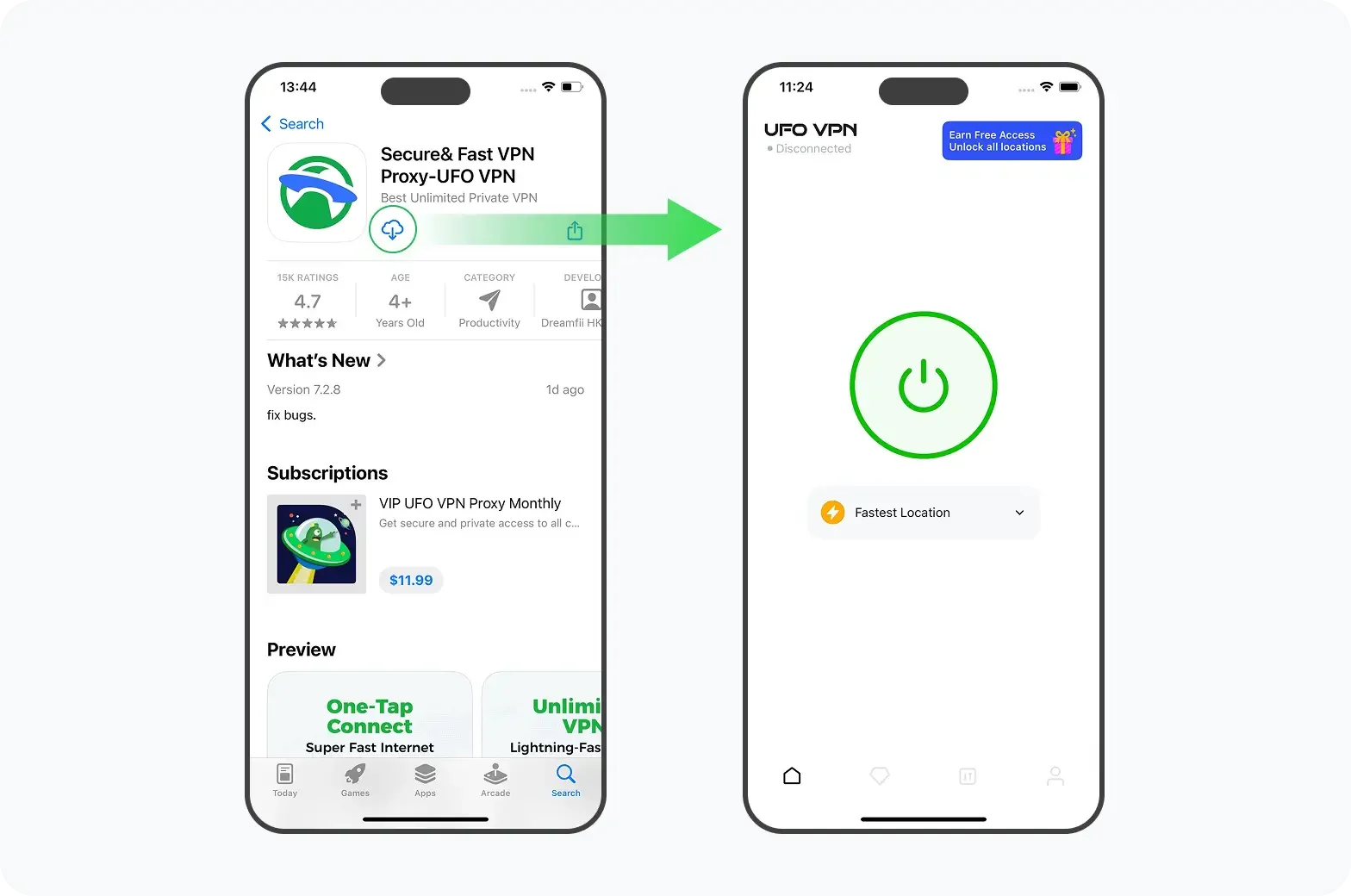

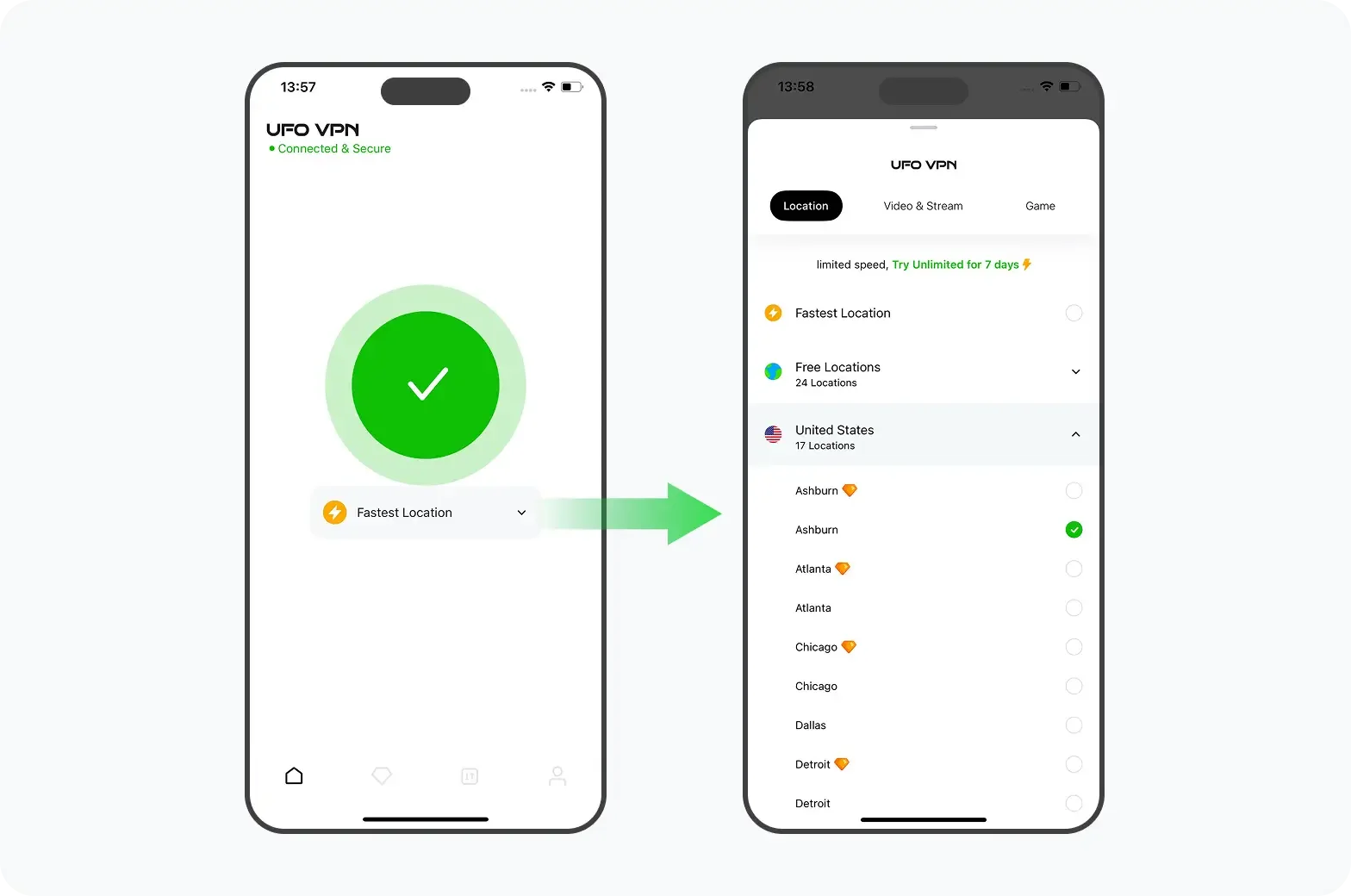

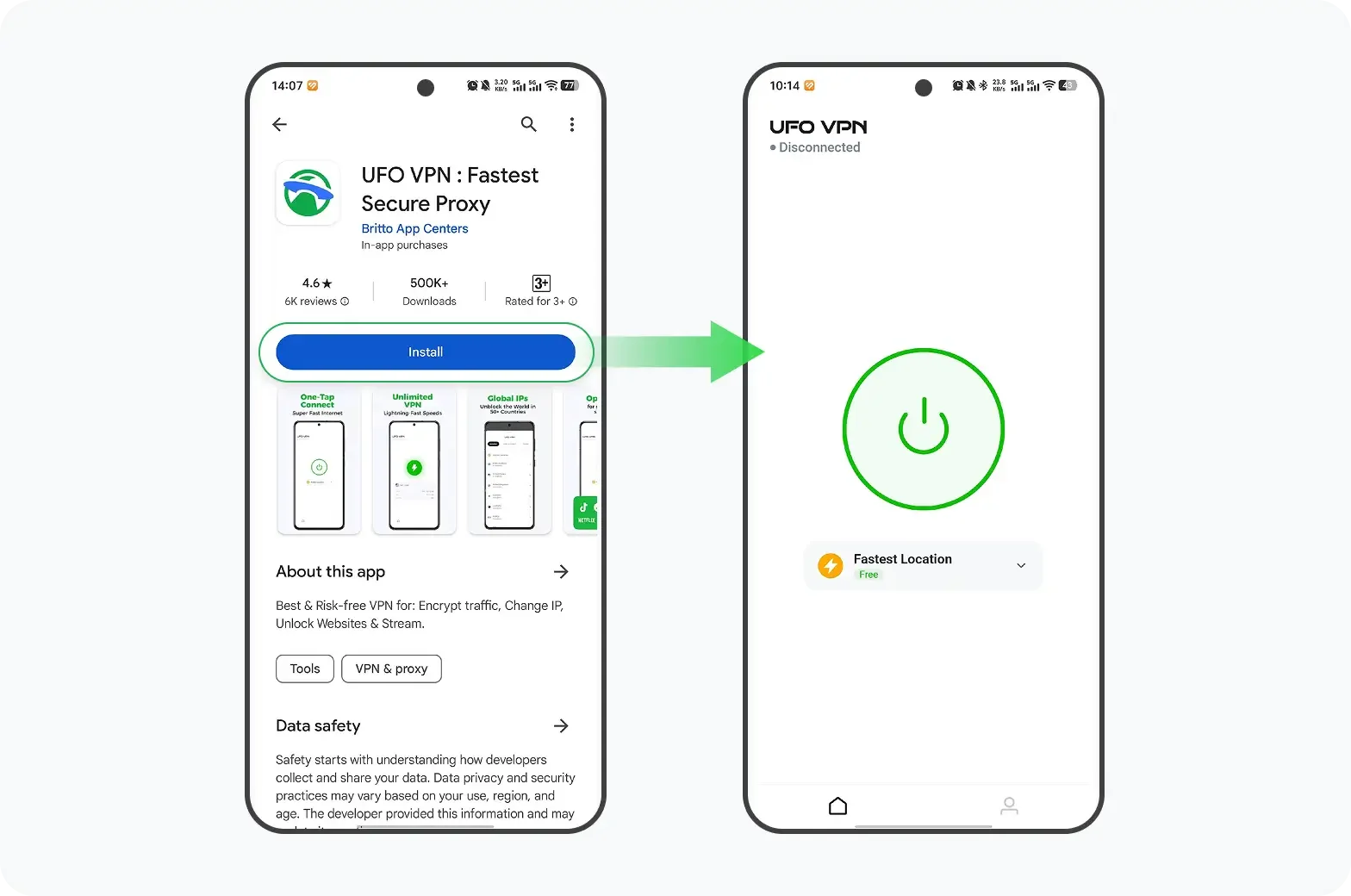

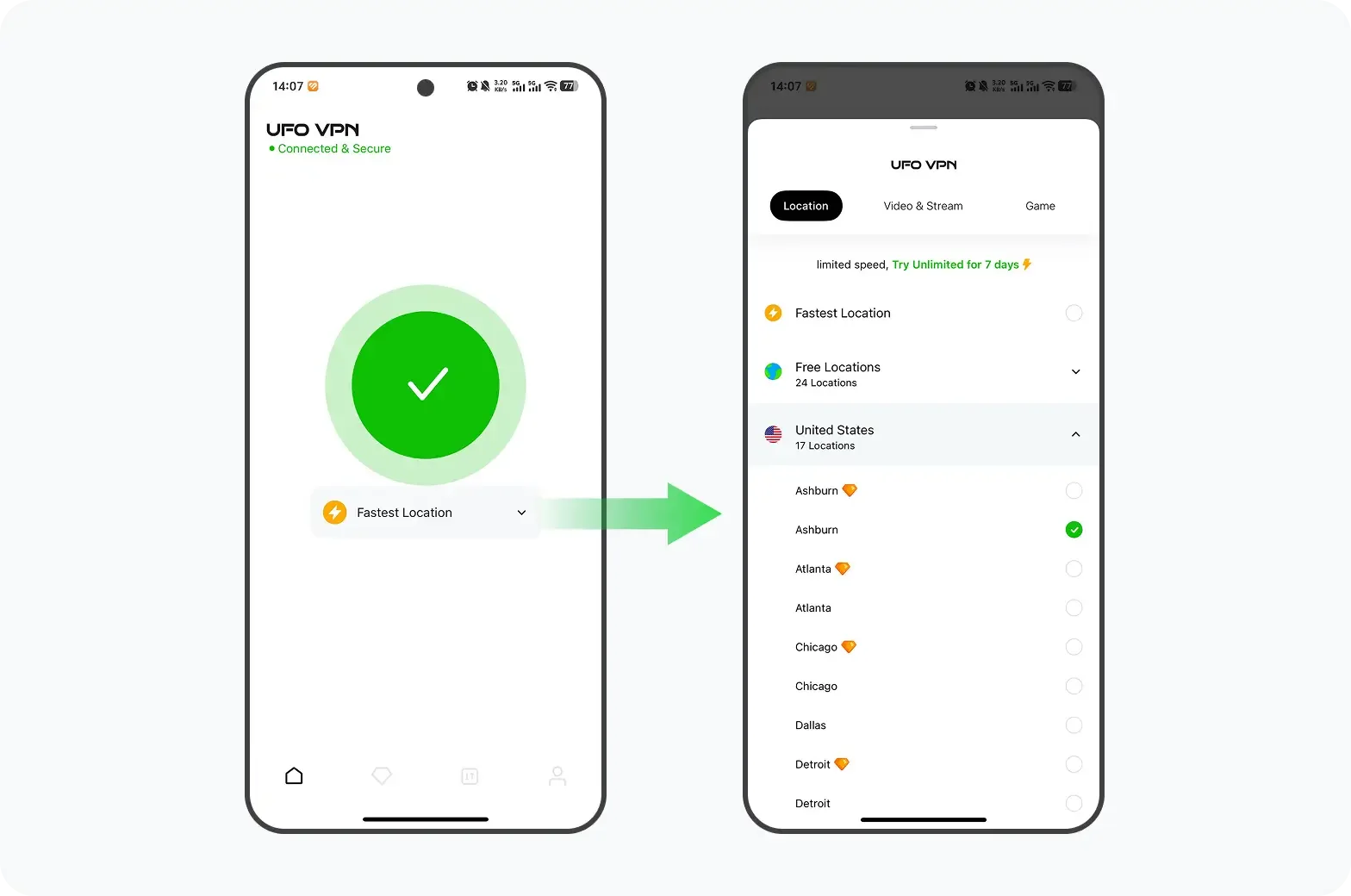

Enhancing Online Security with Best free VPN

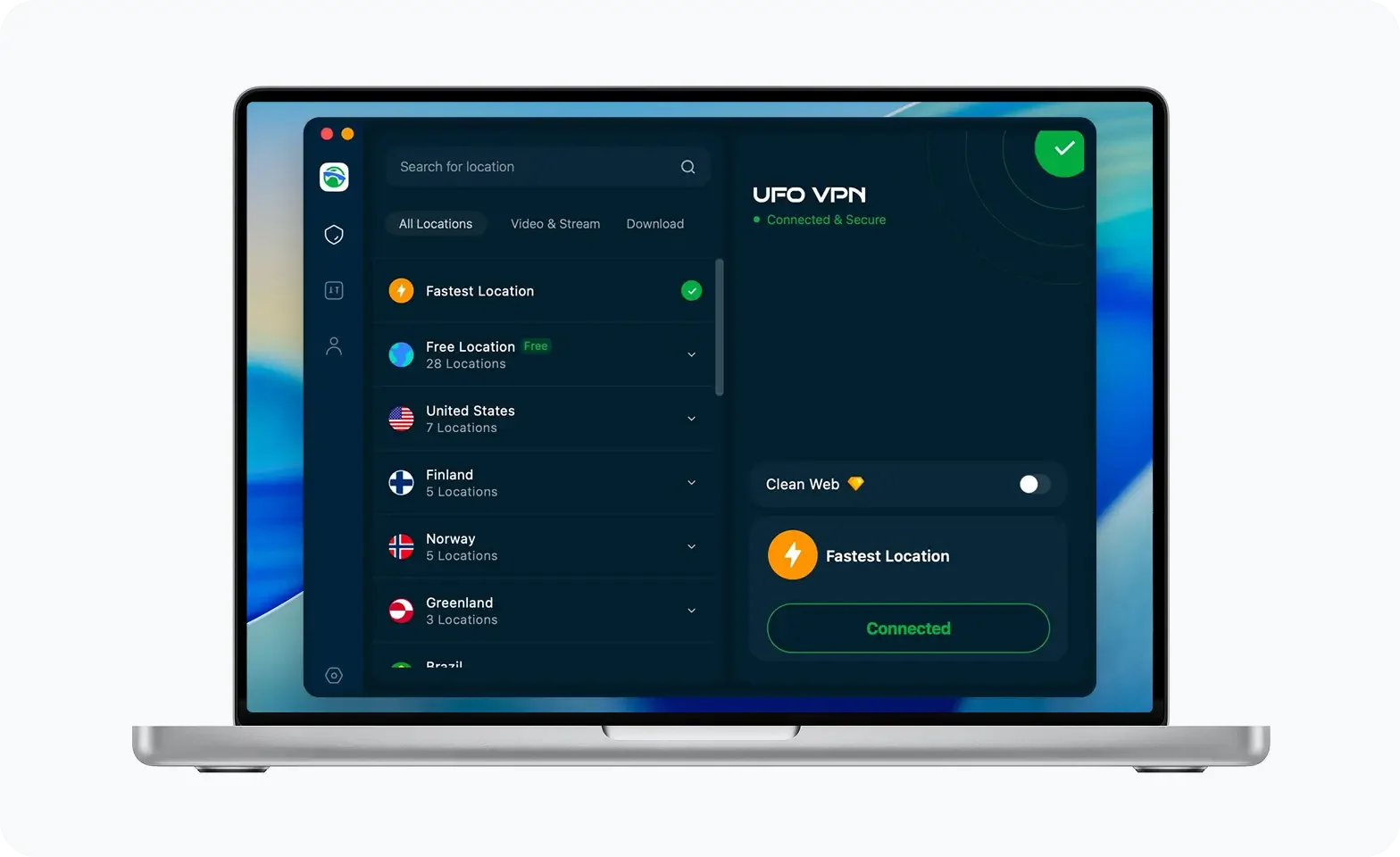

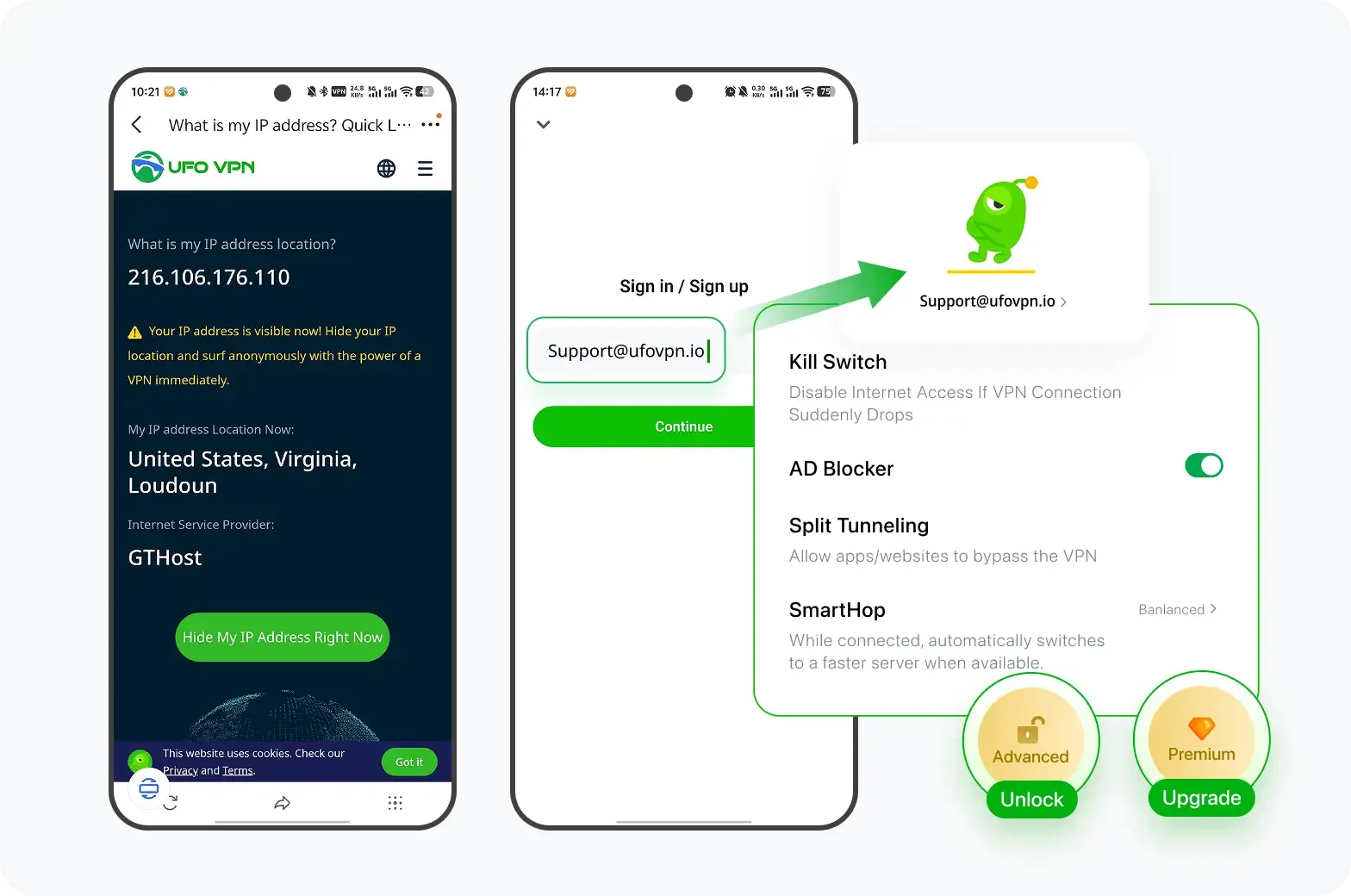

In today’s threat landscape, an extra layer of protection is always beneficial. UFO VPN offers robust security features that complement your efforts to avoid payment fraud. Here’s how UFO VPN enhances your online security:

Key Benefits:

- Encrypted Browsing: UFO VPN encrypts your internet traffic, preventing hackers from intercepting your data.

- Anonymity: It masks your IP address, making it harder for scammers to track your online activities.

- Bypass Geographic Restrictions: UFO VPN enables you to access services securely, regardless of regional restrictions.

- Enhanced Performance: With fast, low-latency servers, UFO VPN ensures that your online transactions and communications remain uninterrupted.

UFO VPN is an all-in-one VPN that offers unlimited access to 4D streaming like Netlfix, Disney Plus, no-ping gaming as PUBG, Roblox, CODM and social networking for YouTube, X, Facebook and more.

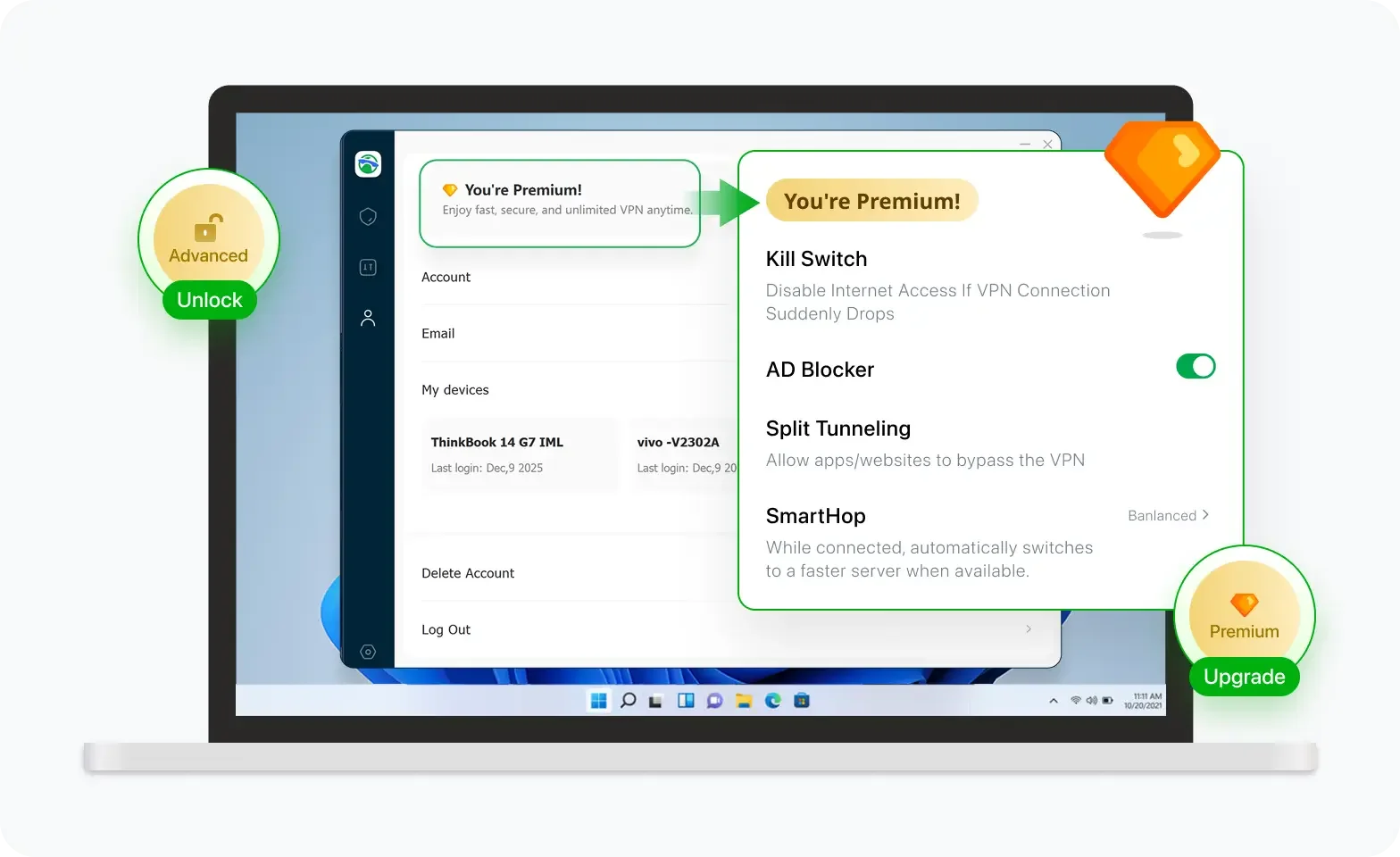

Unlock Pro Features

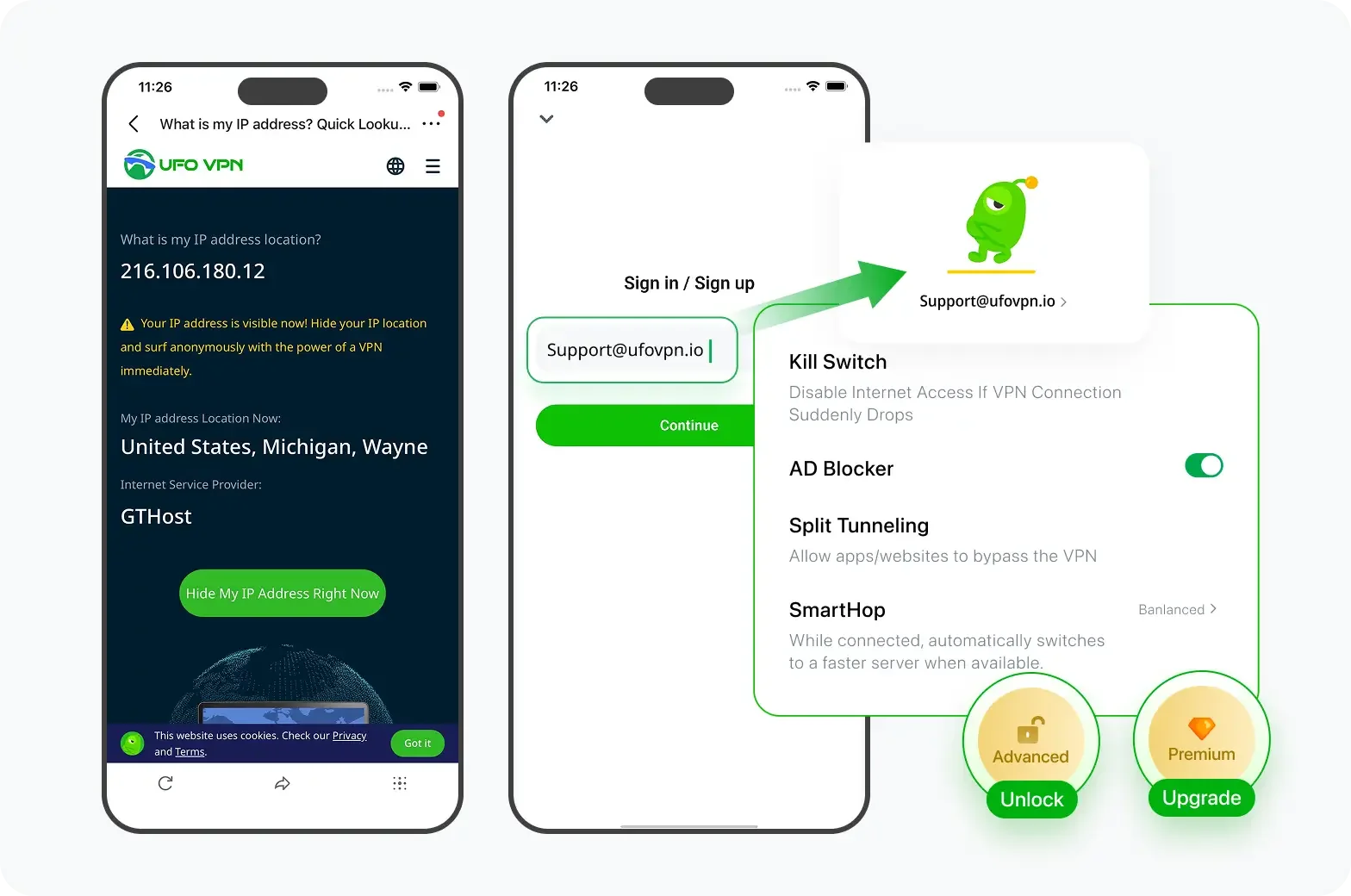

If you have upgraded to premium plan , feel free to enjoy premium servers for 4K streaming and advanced features like Kill Switch, Split Tunneling, and gaming acceleration. Your Mac is now fully optimized and protected. Inaddition to basic functions, we recommend you turn on

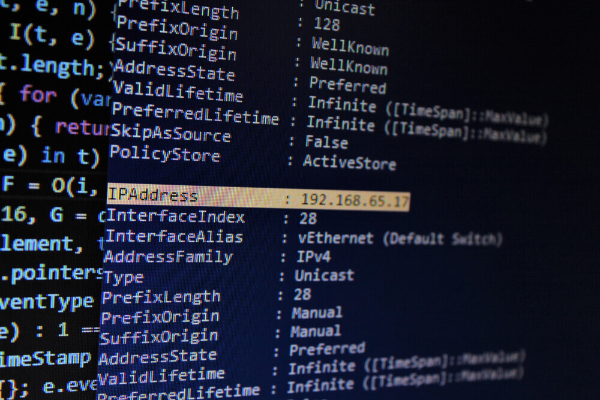

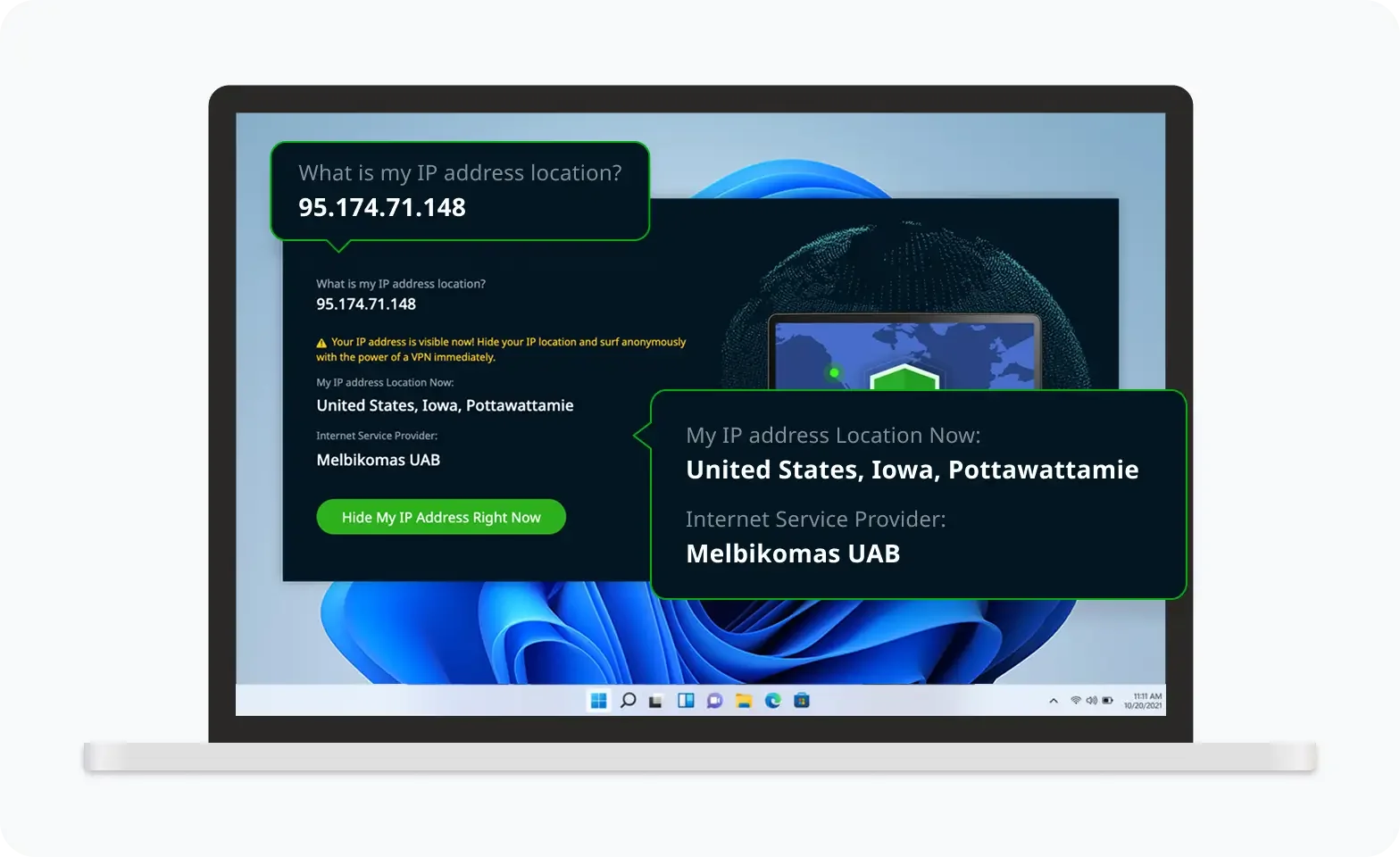

Verify Your IP Now

Use UFO VPN's " What is My IP " feature to see your new IP and location. This confirms your connection is secure, anonymous, and ready for safe browsing online anywhere at any time.

Steps to Take If You’re a Victim

Despite taking all precautions, if you suspect that you’ve fallen victim to a CCSPayment scam, act immediately to minimize damage:

1. Secure Your Accounts

- Change Passwords: Immediately change passwords for affected accounts, and enable MFA if not already active.

- Contact Financial Institutions: Inform your bank or credit card issuer of any unauthorized transactions.

2. Report the Scam

- File a Complaint: Report the incident to your local law enforcement and national fraud reporting agencies.

- Notify the Company: If the scam involved a company (like CCSPayment), notify their fraud department so they can take appropriate action.

3. Monitor Your Credit

- Credit Alerts: Set up credit monitoring services to detect any unusual activity.

- Freeze Your Credit: Consider placing a freeze on your credit report to prevent new accounts from being opened in your name.

4. Seek Professional Assistance

- Cybersecurity Experts: If necessary, consult a cybersecurity professional to help secure your digital presence and advise on further steps.

Taking swift action can help contain the damage and prevent further financial loss.

💖Pro Tips💖

UFO VPN prioritizes your privacy by blocking ISPs, advertisers, and cybercriminals from harvesting data about your device or habits. Recognized as the best VPN for PC and best VPN for Mac, its advanced encryption anonymizes your connection, ensuring activities like visiting onion sites never reveal your hardware specs, browser fingerprints, or real IP address.

With one-click activation, UFO VPN simplifies security—no technical expertise needed. Start shielding your data by using best VPN for PC and browse with uncompromised confidence.

Frequently Asked Questions (FAQs)

What is a CCSPayment scam?

A CCSPayment scam is a fraudulent scheme where attackers impersonate a legitimate payment service to trick victims into providing sensitive financial information or authorizing unauthorized transactions.

How do I know if I’m being targeted by a CCSPayment scam?

Look for red flags such as unsolicited emails, urgent requests for personal information, poor grammar in communications, and suspicious links or attachments.

Can I recover my money if I fall victim to a CCSPayment scam?

While recovery is difficult, immediately contact your bank or credit card issuer to report fraudulent transactions. They may be able to reverse charges or offer guidance on next steps.

How can I protect myself from payment fraud?

Verify the authenticity of all financial communications.

Use multi-factor authentication on financial accounts.

Regularly monitor your account activity and credit reports.

Educate yourself about common scam tactics and stay updated on security best practices.

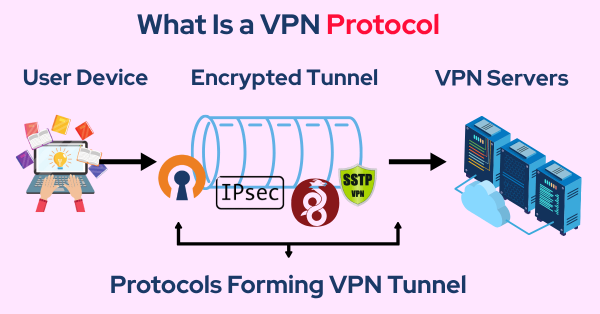

What role does a VPN play in preventing payment fraud?

A VPN, like UFO VPN, encrypts your internet traffic, protecting your data from interception by hackers. It also masks your IP address, which helps maintain your anonymity and security during online transactions.

Are there specific signs that distinguish CCSPayment scams from other types of payment fraud?

Yes, CCSPayment scams often involve imitating the branding and communication style of legitimate payment services, use urgent language, and may include fake customer support details. Always cross-verify any communication through official channels.

Is it safe to share my personal information if I receive a message claiming to be from CCSPayment?

No. Legitimate companies rarely ask for sensitive information via unsolicited emails or messages. Always verify directly using trusted contact information before providing any personal details.

Can installing antivirus software help prevent these scams?

Yes, reliable antivirus and anti-malware software can detect and block phishing attempts and malicious links, adding another layer of defense against scams.

What should I do if I suspect a scam but am unsure of its authenticity?

Contact the company directly using verified contact details from their official website. Do not use any contact information provided in the suspicious message.

Final Thoughts

Dealing with a "CCSPayment" scam requires vigilance and a proactive approach to online security. By understanding how these scams operate, recognizing red flags, and following best practices for digital safety, you can protect your money and personal information effectively. Strengthen your defenses with robust tools like UFO VPN for encrypted browsing and added security. Stay informed, stay cautious, and don’t let scammers dupe you—your financial safety is worth every precaution.